-

Expected Credit Loss CalculatorBrought to you byW.consulting has developed the ECL.Calculator, for Trade Receivables.The ECL.Calculator takes

Expected Credit Loss CalculatorBrought to you byW.consulting has developed the ECL.Calculator, for Trade Receivables.The ECL.Calculator takes

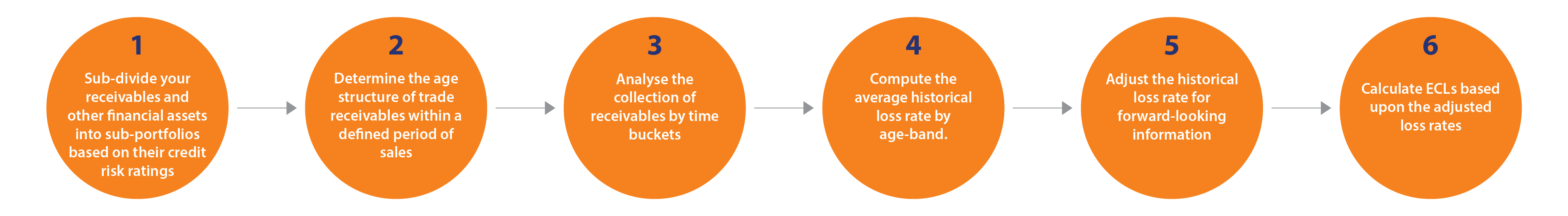

information that most entities already have regarding the historical credit behaviour of their

customers and applies IFRS Intelligence and quantitative methods to deliver an IFRS 9-compliant

ECL computation which incorporates forward-looking Information

“Please note that the outcome of the ECL above does not capture the impact of covid-19 in both the next 12 months and beyond.

Management should therefore consider an overlay to add to the calculated provision capturing the expectation of the likely impact on the segment/business modelled.

The overlay will act as an additional stress on the Expected Credit Loss produced by the ECL Calculator. Such overlays are qualitative in nature and are allowed under IFRS 9”